The BCG matrix is a planning and analysing tool developed for Boston Consulting Group by Bruce D. Henderson in 1968. Its purpose is to help analyse various businesses and product lines. Here we will learn what it is, how it works, its various aspects, and its shortcomings.

BCG Matrix - FAQs

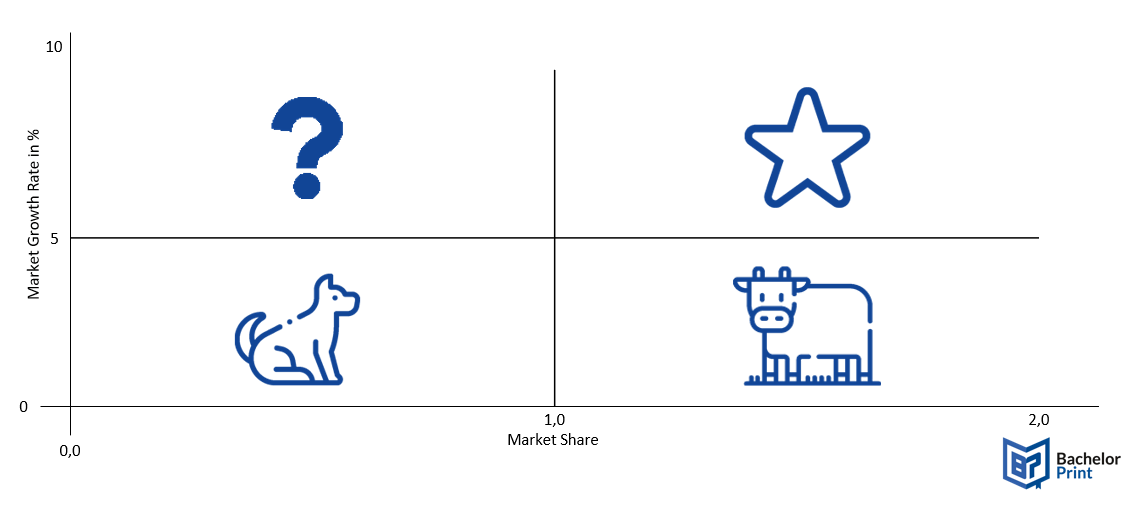

- The Dogs (squinted market share, economic growth rate)

- The Question mark (towering market share, economic growth rate)

- The Cash cows (towering market share, economic growth rate)

- The Stars (towering market share, towering growth)

The matrix tells if the business or products are yielding or not. This allows the company to decide where to invest more and where to terminate investment and development.

- It classifies a business as either modest or soaring, which is not always true; it can be a medium. However, this means you will never know the real nature of the business.

- It does not reflect the business model.

- The high market shares are not guaranteed to lead to increased gains since there is an increased cost involved with such results.

- This model ignores or overlooks other indicators of profitability.

- The approach of the chart is taken less seriously due to its simplicity.

- The tool offers businesses and institutes a unique way to see opportunities for each product or business portfolio

- Enables a corporate to commence a significant decision when allocating their limited resources

- The framework shows if the firm’s creative work is balanced.

The unknown symbolises diversification. Ideally, the puzzle helps the company decide whether to keep, sell or invest more in a particular item.

Definition: BCG Matrix

BCG matrix is a framework used to help a vast or small business determine prolonged strategies to assist finding unique chances of business development by analysing its creative work of items then the corporate or deciding where to invest, terminate, or develop things.

The four components of the BCG matrix

The BCG Matrix indicates a firm’s portfolio. Each product is plotted on the quadrant depending on its parallel market piece. It is on either (Y-axis) and its speed (X-axis). BCG matrix chart graph is separated into four sections that include

- Cash cows

- Dogs

- Stars

- Question marks/unknowns.

Dogs

These are businesses or products that have shallow growth projections in an equally low shares market. Their position is on the lower right of the quadrant grid, and they do not give rise to cash. However, some of them can turn out to be cash baits for the long-term.

Question marks or unkowns

These are businesses with progressive market growth but a low market share. Unknowns are very tricky, and they require so much attention since the company is consuming finances and create a small return. In this section, the direction is hard to perceive. They have the potential to be either a star or a dog; therefore, the need for a closer look to determine its progress potential.

Cash cows

These are items that have low market growth but a high market value. Firms should not invest in cash cows to boost their development, but they should support them to maintain their current market division. Unfortunately, this is not always the truth. Most large corporates are cash cows capable of developing new products and processes, which usually turn out to be stars.

Note that they lack support; most of them would not be capable of coming up with unique innovations.

Stars

The stars involve businesses or items with a successful growth in the market and successful market shares. Star company’s or products can bring substantial profits since they generate more ROI. Furthermore, they can become cash cows at the finishing line of the product or business cycle, which can fund future investments.

in Your Thesis

How to create a BCG matrix

The model is used in huge and small businesses. Here is a step-by-step guide on how to create one.

Find the section containing the specific line, strategic business section, or the entire firm, and be surveyed using the tool. Keep in mind that the selected area controls the whole survey and critical classifications. Also, the competitors, markets, and industry will be positioned depending on the chosen unit.

Group the businesses after selecting the unit and the specific section to be surveyed. Note that a bad selected market can take to an incorrect grouping of the firm. For example, a range rover surveyed in a passenger’s vehicle category will be grouped as a dog with a little to no market division. bdStill, when analysed in the luxuries category, it will be a cash cow with a towering market division.

Calculate the moderate market division

In this section, the close market division for the chosen department needs to be analysed. The formula to use in this section is the division of all highlighted labels, market division, or revenue of the industry’s biggest competitor. When done, plot the results on the x-axis.

Calculate the market development rate

In this section, online business reports can be used to calculate the brand development rate. When it is impossible to see this, you can estimate this by checking the number one expected revenue growth. The company can calculate the overall to measure percentage and then plot this on the y-axis.

Make a circle on the BCG matrix

When all the measurements and calculations are complete, add them to the BCG matrix. To achieve this, you can make a circle around each brand or company within the entire firm. Note the size of the ring should drop a line to revenue raised by the brands.

This is how your BCG matrix could look like:

Good to know: If you want to learn more about other methods & concepts, click the link!

Limitations of the BCG matrix

Even though the BCG gives a unique skeleton for sharing the limited assets among specific brands and products and comparing the label’s performance at once. The BCG matrix is not far from limitations such as;

When it comes to establishing a corporate competitive power, the market division is only one factor to consider. Ideally, there are several factors to consider, such as brand equity, transportation, and others. In a few cases, comparable market divisions could be a fair measure of competitive power, especially in an economic growth rate market, i.e., for the dogs and cash cows. Unfortunately, it will not be useful in the towering growth markets where there is a competitive environment. Therefore, this means the market division is far from being dynamic.

Another limitation or concern involves “what should the firm plot on the BCG matrix?” Initially, the group developed the BCG for large firms and businesses with multiple and often unrelated business units in their entire portfolio. The BCG matrix purpose is to plot a colossal interest onto a simplified graph. Thus, help both large and small firms compare how they shall allocate comprehensive corporate resources across the entire business.

Over the past few decades, the BCG matrix has transitioned through usage to plot private labels and products. Therefore, BCG matrix limitations for strategic outcomes will not be correct. For example, when a firm with a vast product range devises a personal effect on a BCG matrix, they will note that they have combined both the dogs and the cash cows. Therefore, the firm or the individual must be cautious while plotting a particular brand product on the BCG matrix.

In a Nutshell

- To ensure that you have an excellent BCG matrix starting point, you need to implement a strategic intent to plan and align its mission.

- The 2, 3, and 4 categories or quadrants BCG matrix outlines in this article help improve a company’s deliberate emergency strategy, thus improving its overall calculated management exercise.

- Since the introduction of the BCG matrix, the whole commerce environment has changes becoming more dynamic and unpredictable.

- For the BCG matrix, Cash cows are head in the marketplace since they bring about more cash than they spend. Furthermore, they towering market but economic progress rate prospects, which is a good indicator for any enterprise.

- When measuring a firm’s competitive power, you should measure the comparative market division and growth and other prospects such as logistics, financing, and equity.